- Strong Q3 Performance and Atlas Growth:: MongoDB reported $628.3M revenue (19% YoY growth) with Atlas accounting for 75% of total revenue and growing 30% YoY, signaling robust cloud-native adoption.

- Leadership Transition:: Chirantan "CJ" Desai, former executives at Cloudflare and Oracle, assumed CEO role in November 2025, bringing cloud infrastructure expertise critical for AI-driven growth strategy.

- High Valuation Metrics:: Traded at ~12× trailing sales and 80× forward earnings, similar to peers like Snowflake, but significantly higher than traditional databases like Oracle, reflecting growth expectations and AI potential.

- AI and Vector Search Momentum:: MongoDB’s vector search capabilities for RAG and AI workflows position it as a key player in the $226B database market by 2028, with 74% of organizations planning to adopt integrated AI databases.

- Guidance Raise and Cash Flow Strength:: Fiscal 2026 revenue guidance increased to $2.434–2.439B (21–22% growth), with Q3 free cash flow of $140.1M, highlighting scalable operations and margin improvement potential.

Valuation & Price Target Analysis: MongoDB (MDB) As of December 2, 2025

MongoDB's stock has surged following its transformation into a cloud-native database leader and its positioning for the AI era. This analysis explores valuation metrics, growth scenarios, and competitive dynamics to assess potential price targets and risks.

Author: Analystock.ai

Current Valuation (December 2025)

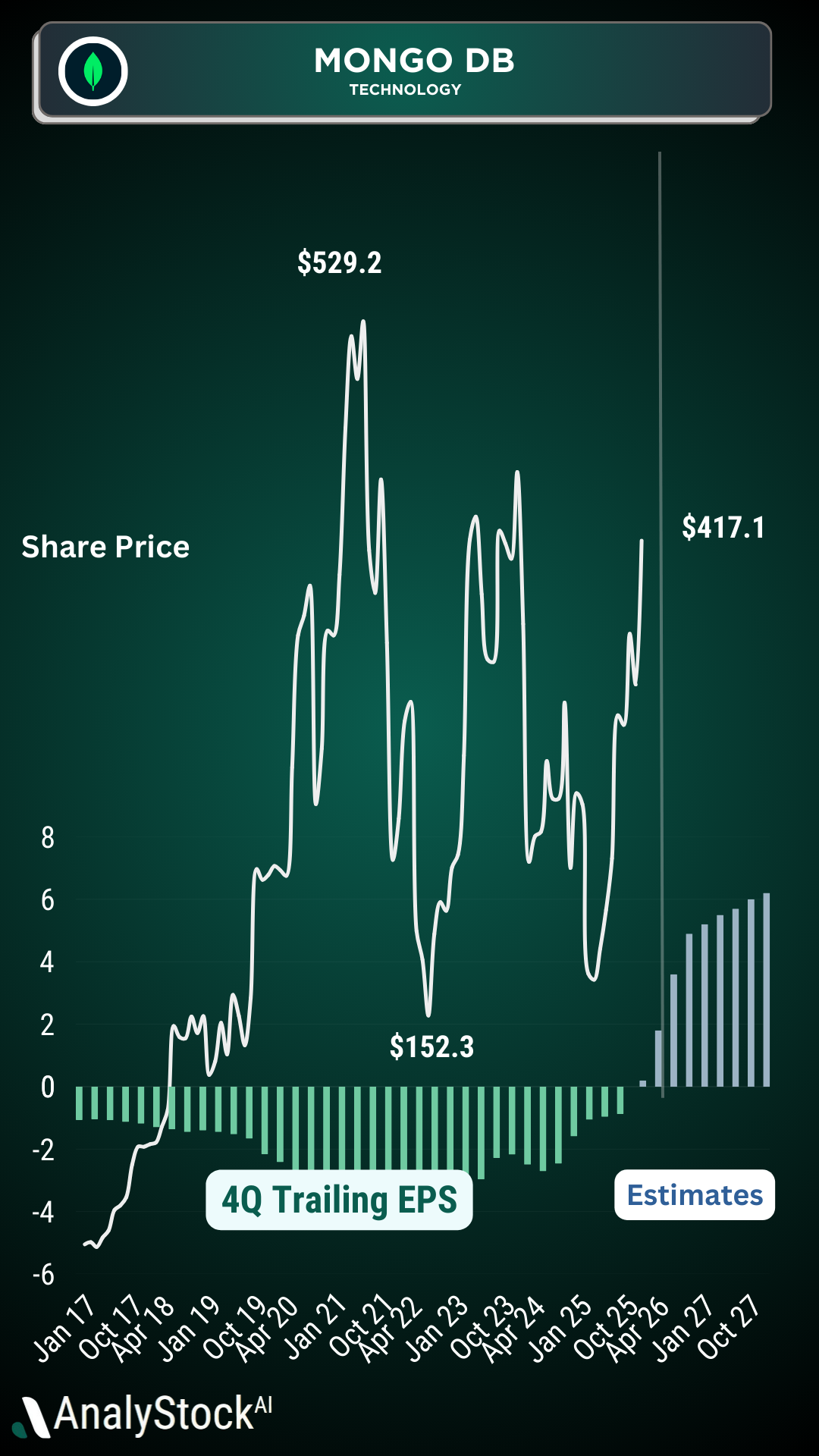

MongoDB's market cap is approximately $27 billion, with a stock price of ~$329 per share as of December 1, 2025, though it surged 22% in after-hours trading post-Q3 fiscal 2026 earnings. The valuation reflects its evolution from a NoSQL alternative to a comprehensive developer data platform. It trades at ~12× trailing sales (TTM revenue of ~$2.3B) and ~80× forward earnings. Peer comparisons show similar multiples to Snowflake but significantly higher than traditional vendors like Oracle. Q3 fiscal 2026 results highlighted 19% YoY revenue growth ($628.3M), with Atlas (75% of revenue) growing 30% YoY. Free cash flow reached $140.1M, and management raised 2026 guidance to $2.434–2.439B revenue (21–22% growth) with adjusted EPS of $4.76–4.80. Leadership transition to Chirantan 'CJ' Desai adds strategic credibility for AI-driven growth.

Base Case (12-Month View)

Assuming steady execution, MongoDB could sustain 15–20% revenue growth through fiscal 2027, reaching $2.8–3.0B in revenue. With non-GAAP operating margins expanding to 22–23%, adjusted EPS could reach $5.50–6.50. A 60–70× forward earnings multiple supports a $380–420 stock price. Analysts have raised price targets post-Q3, with Goldman Sachs ($475) and Wolfe Research ($500) leading. Upside scenarios (35% Atlas growth and AI adoption) could push the price to $480–500, while downside risks (25% Atlas growth or macro headwinds) imply $280–320.

Bull Case (3–5+ Years)

In a bullish scenario, MongoDB could dominate AI-driven database workloads with vector search capabilities, expanding Atlas revenue to $4–5B by 2028–2029. Non-GAAP operating margins could reach 25–30% by 2030, supporting $8–10B revenue and $2.0–2.5B net income. Strategic partnerships with cloud providers and AI frameworks would strengthen its ecosystem. A 30× earnings multiple implies a $60–75B market cap ($650–850/share). If AI adoption accelerates further, a $10B revenue and 10× sales multiple could push the stock to $1,000+ by 2030.

Bear Case

Competitive pressures from PostgreSQL, cloud giants, and specialized AI databases pose risks. If AI benefits fail to materialize or economic downturns slow IT spending, revenue growth could stall to low-double digits by 2028. Non-GAAP margins might compress to 15–20%, leading to a $4–5B revenue and $600–800M net income. A 20–25× earnings multiple would imply a $12–20B market cap ($150–250/share). Even a moderate bear case (60% revenue growth to $6B) would cap the stock at $300/share, underperforming current valuations.

Comparables and Relative Valuation

MongoDB's 12× sales multiple is reasonable for its 20%+ growth and 20% non-GAAP margins. Peers like Snowflake trade at similar premiums, while traditional databases (Oracle) have lower multiples. Morningstar's 'no-moat' rating highlights risks of eroding competitive advantages. The valuation assumes MongoDB captures significant AI workload share. If it fails to differentiate, multiples could compress to align with slower-growth peers.

Price Target Summary

- 12-Month: $380–420 (base), $480–500 (upside), $280–320 (downside).

- 3-Year: $500–650 (base), $700–900 (bull), $300–400 (bear).

- Long-Term: $650–850 (bull), $150–250 (bear), $280–320 (moderate bear).

Key Considerations for Investors

- Leadership Transition: New CEO CJ Desai's execution and strategic direction are critical.

- AI Monetization: Vector search adoption and revenue contribution will validate growth potential.

- Valuation Sensitivity: Premium multiples leave little room for execution errors.

- Competitive Dynamics: Threats from open-source and cloud-native alternatives require continuous innovation.

- Market Opportunity: $226B database market by 2028 offers growth but depends on MongoDB's share capture.

Final Thoughts

MongoDB is at an inflection point, leveraging AI and cloud-native capabilities to redefine its market position. While the bull case envisions $1,000+ stock by 2030, the bear case warns of $150–300. The most likely path sees $500–700 by 2028–2030. Investors should monitor Atlas growth, AI customer wins, and margin expansion. Position sizing and risk management are essential given the stock's volatility and high valuation.